Hundreds of UK companies could be using the Isle of Man to potentially hide their true ownership, a tax expert claims.

Dan Neidle, founder of Tax Policy Associates, has carried out research which suggests that 50,000 UK companies could potentially be hiding the identity of their beneficial owners - and believes the ‘vast majority’ are breaking the law.

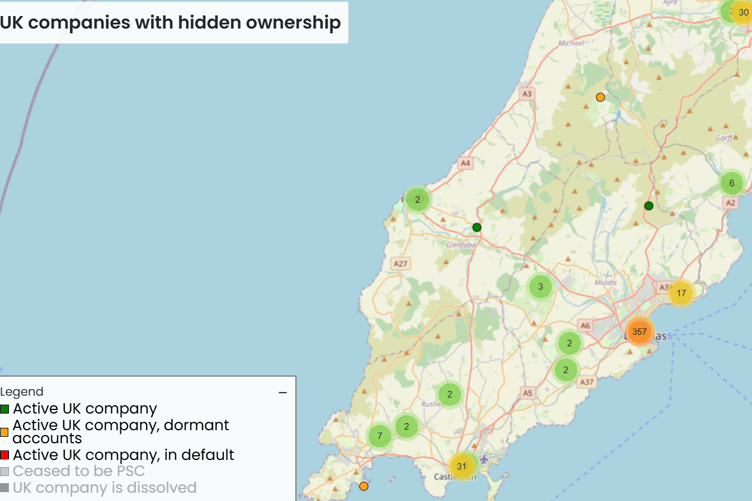

Using publicly available data from Companies House, he has created an interactive online map that shows those businesses that have declared a non-UK company as their person of significant control rather than the individual who actually owns or controls them.

A total of 534 of these have listed a Manx company as their beneficial owner.

The interactive map shows active UK companies, those with dormant accounts and those in default.

Giving evidence on the issue of economic crime to the House of Commons business and trade sub-committee last week, Mr Neidle said UK Companies House has been a victim of its own success with its digital transformation making it ‘incredibly easy’ to incorporate a company.

‘By accident, we have created something that has enabled very large-scale fraud by people across the world,’ he told MPs.

Since 2016, UK companies have been obliged to identify their person of significant control (PSC) - usually the ultimate shareholder - under rules designed to prevent fraud and money laundering.

The rules state this should be an actual person or a UK company, but not a foreign company - and that includes the Isle of Man or other international finance centre.

Mr Neidle notes there are cases where it is legitimate to report a foreign company as a PSC including listed companies and widely held companies where no one has more than 25% of the shares or voting rights.

And he concedes the interactive map may be imperfect - some listed companies may have slipped through the net and the map may include some UK PSCs that are not breaking the law but simply didn’t enter their address correctly.

A spokesman for the Isle of Man Government said: ‘The Isle of Man has no interest in facilitating illicit finance and has legislation in place to ensure that adequate, accurate and current details are maintained on the true ownership and control for all legal entities.

‘These details are fully accessible at all times to law enforcement agencies.

‘Whilst enforcement of UK legislation is a matter for them, the Isle of Man cooperates closely with the UK in respect of sharing beneficial ownership information.

‘Under the Exchange of Notes (EoN) agreement with the UK, the Isle of Man can respond to requests for Beneficial Ownership Register information from UK Law Enforcement agencies 24 hours a day, seven days a week. Average response times for this information is around 1 hour 20 minutes.

‘In line with the Isle of Man’s commitment to improving access and transparency in respect of beneficial ownership registers, access to obliged entities (licensed entities doing customer due diligence checks) was opened up in December 2024. ‘

Mr Neidle told the Commons committee: ‘One particular problem is with foreign directors. Obviously, you cannot prosecute or even fine, or probably even write to, a foreign director, so what do you do?

‘When you talk to people in the Caymans or Jersey, they are amazed at how Companies House operates. In most countries like that—I should probably say tax havens—I could not incorporate a company myself; I would have to go through a licensed incorporation agent.

‘Here, we have taken the policy decision that we do not want to put barriers in the way of small businesses, so anyone can incorporate a company.

‘But if you have a company that has no UK directors, and only has foreign directors, we do not really care about introducing more barriers by way of making it more difficult for people who are not genuine to set up a company.’

Mr Neidle said Companies House should be smarter about raising red flags when there are suspicious entries and should be more aggressive in prosecuting when rules are breached.

And he suggested that a company should be banned from having only foreign directors, unless it has a UK agent acting for it, which he said would make it harder to carry out fraud.

Companies House pursued 43 prosecutions for PSC infringements in the first year of the new rules in 2016 but since then numbers have dwindled.

Mr Neidle pointed out that Manx-registered companies will have an agent who should be aware of any inconsistences with information supplied to Companies House in the UK.

What do you think? Share your thoughts by emailing [email protected] for potential publication in our letters page. Please include your name, address, and phone number for verification. We won’t print phone numbers or full addresses, and anonymity requests will be respected where possible. Join the conversation!

.jpg?trim=0,0,0,0&width=752&height=501&crop=752:501)

.jpeg?width=209&height=140&crop=209:145,smart&quality=75)