The Treasury Minister says that increased flood insurance premiums following the Laxey flood four years ago remains a matter for insurance companies.

Alex Allinson made the statement in a written response after being quizzed on the matter by Garff MHK Daphne Caine.

Insurance premiums paid by some Laxey residents have rocketed since the Laxey River burst into Glen Road, damaging 62 properties, back in 2019 flood,

The Government said it explored joining the UK’s ‘flood reinsurance scheme’ in the wake of the incident.

The scheme acts to keep insurance for households at risk of flooding at an affordable price.

Dr Allinson said: ‘The Treasury had sought to enter negotiations with the UK DEFRA in March 2021 with a view to seeking the entry of the island to the UK’s Flood Re Scheme.

‘A meeting was held in June 2021, where two key issues emerged.

‘One issue was that even if negotiations were to have proceeded there would have had to be an amendment to UK primary legislation, which could only be considered further if the second issue could have been addressed.

‘The second issue to be surmounted would have been agreeing a formula for aligning the island’s rating system with the UK Council Tax Banding system. It became clear to Treasury that seeking further communication with the UK was unlikely to result in a successful outcome.’

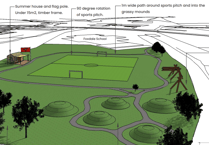

He added: ‘Government has heavily invested in flood mitigation measures in Laxey, which are designed to address the risk of a future significant flood event. Treasury believes the substantial investment in these measures will benefit the residents in Laxey by reducing the likelihood of a future flooding event significantly.

‘Furthermore, the flood management division of the Department of Infrastructure has also been preparing maps, which identify, in granular detail, areas at risk, and those areas at a lower risk, of flooding.

‘Treasury recognises that notwithstanding the substantial investment in flood mitigation measures, and mapping, by government, it remains a matter for individual insurance companies to make their own determination when assessing risk, and offering premiums for individual properties.’

But Garff MHK Andrew Smith has taken matters into his own hands by collating information to take to insurance companies in a bid to persuade them to reduce their premiums.